Improvement In Farmer Sentiment Carries Over Into 2023

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer January results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

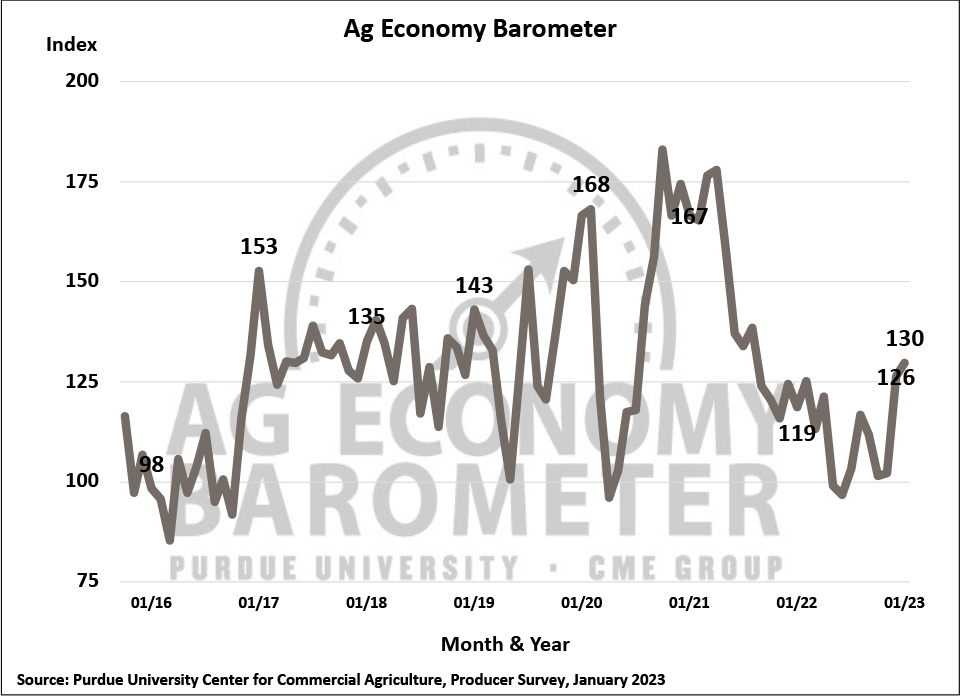

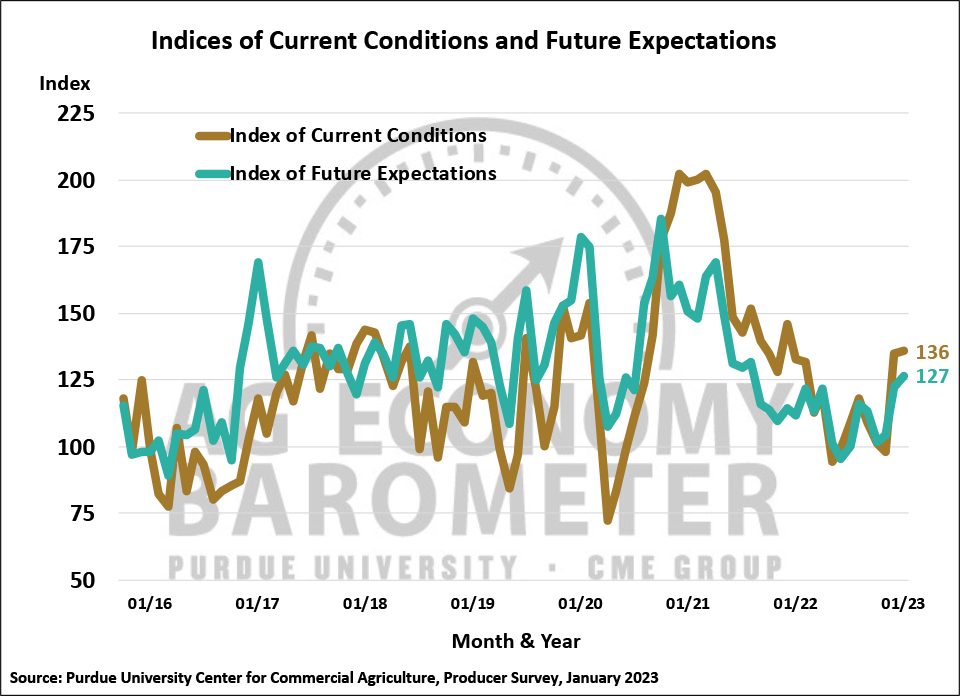

The Purdue University-CME Group Ag Economy Barometer Index rose again in January, to a reading of 130, 4 points above its 2022 year-end index value. The January survey results also pushed the index 34% above its 2022 low point which occurred last June. The barometer’s modest rise in January was primarily attributable to better expectations for the future as the Future Expectations Index rose 5 points to 127 while the Index of Current Conditions, with a value of 136, changed little compared to December. The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from January 16-20, 2023.

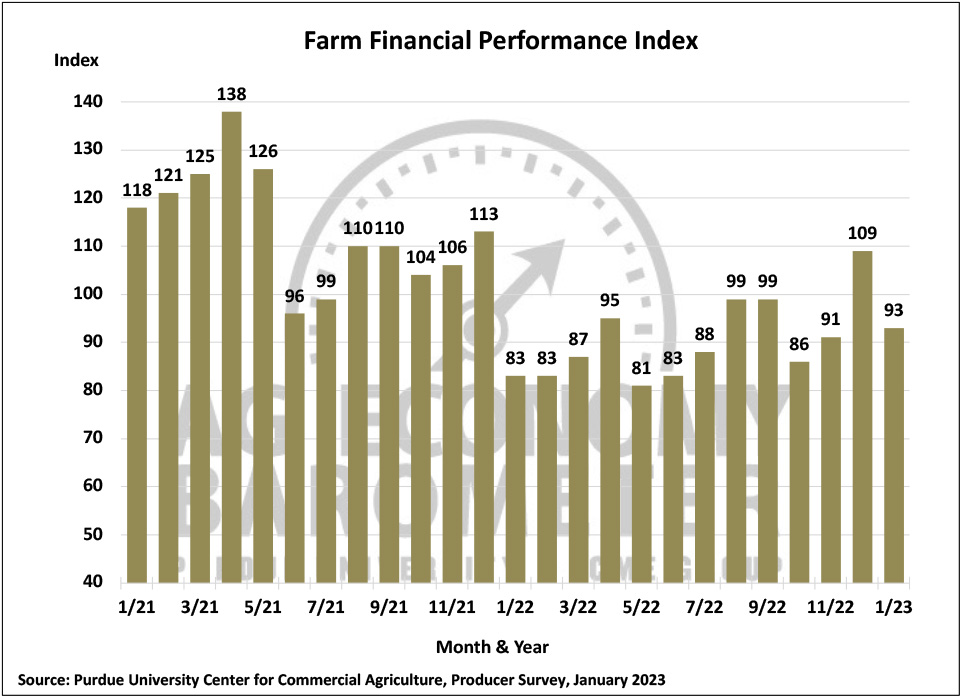

The Financial Performance Index dropped to 93 this month, down from 109 in December, but that primarily reflects producers’ being asked to look ahead to 2023 and compare it to 2022 rather than comparing 2022 to 2021, which is what the question in December did. To help gauge the change in producers’ expectations for 2023 compared to 2022, the December survey included a question asking producers to look ahead to 2023. Responses to that question were similar to those received this month helping confirm that, compared to a very strong income in 2022, producers expect to see margins tighten in 2023.

Twenty-two percent of the respondents in this month’s survey said they expect to have a larger farm operating loan than in 2022, which was down somewhat from last January when 27 percent of respondents expected to have a larger operating loan. Among respondents who expect to have a larger operating loan this year, only 5% said it was because they are carrying over unpaid operating debt while 80% said it was attributable to input cost increases. The percentage of respondents who attribute their need for a larger loan to unpaid operating debt has fallen sharply since we first posed this question in January 2020. In 2020, just over one-third of producers who anticipated needing a larger operating loan said it was because of unpaid operating debt. That percentage fell to 20% in 2021 and 13% in 2022 before declining again to just 5% in 2023. The sharp decline in the percentage of producers expecting to carry over unpaid operating debt provides support to the idea that the vast majority of producers are entering 2023 in a strong financial position.

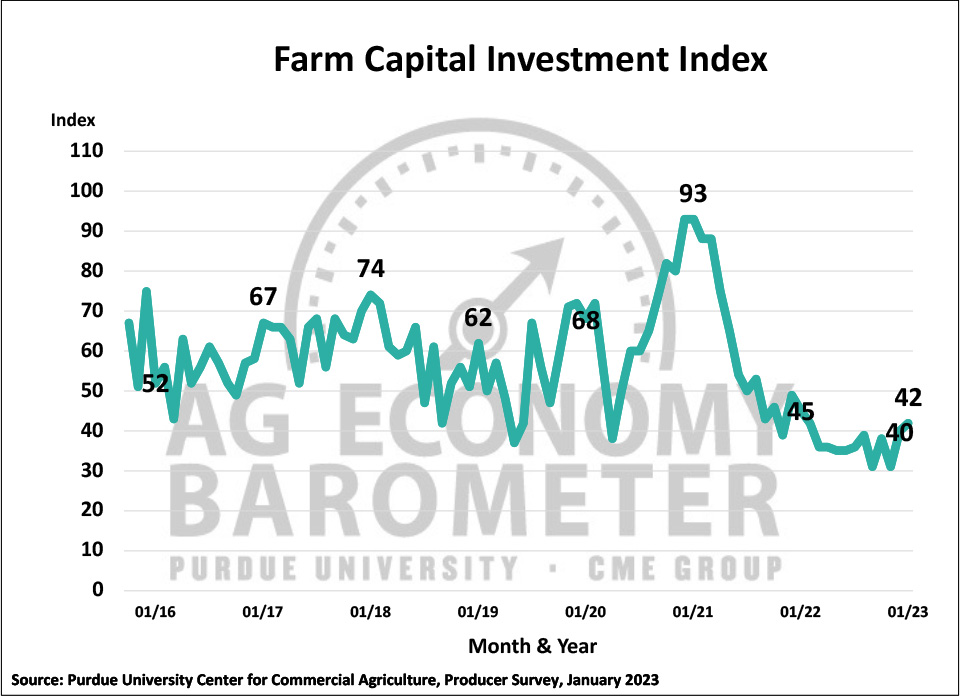

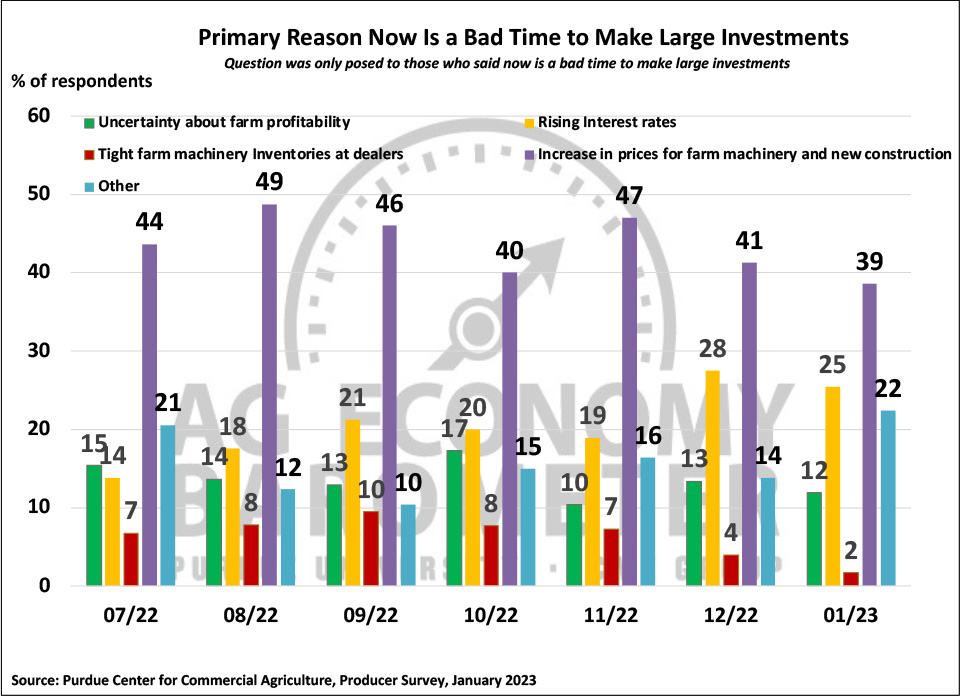

The January reading of the Farm Capital Investment Index climbed 2 points to 42. January marked the second month in a row the index rose, the first time that’s occurred since the fall of 2020. January’s modest rise pushed the index up 35% compared to its November 2022 low, although the index remained 7% lower than a year earlier. Just over 7 out of 10 survey respondents in January said they think now is a bad time to make large investments in their farm operation. Among those respondents who feel that way, 39% said it was because of high prices for machinery and new construction, down from 47% who pinpointed cost as the primary reason for holding off on investments back in November. Compared to November more respondents in January pointed to rising interest rates (25% vs. 19%) and uncertainty about farm profitability (12% vs. 10%) as their primary reason for thinking now is a bad time to make large investments.

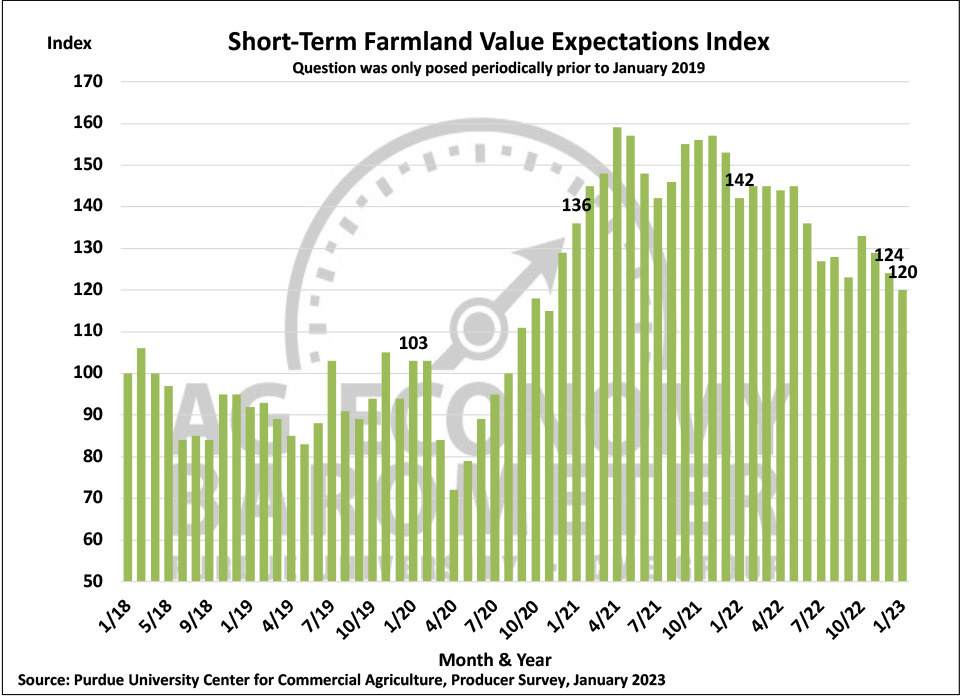

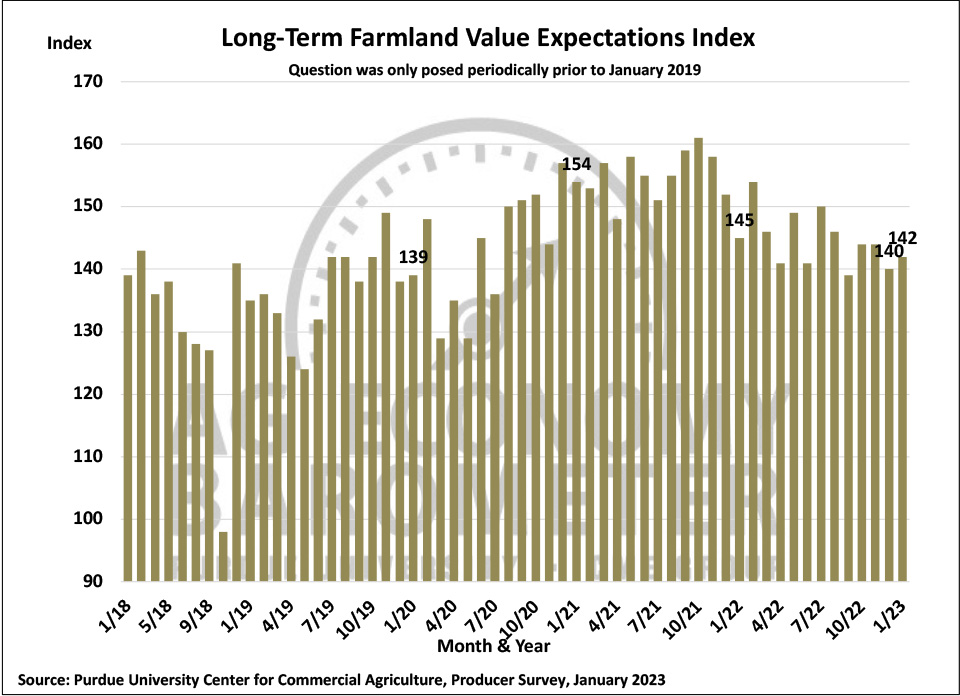

The Short-Term Farmland Value Index declined again in January, falling to 120, 4 points below its year-end reading. Compared to a year earlier, this month’s short-term index was down 22 points, a decline of 15%. Weakness in the index this month was primarily attributable to respondents’ opinion shifting from expecting farmland values to rise in the upcoming year to expecting values to hold steady. The Long-Term Farmland Values Index rose slightly to 142 from 140 in December. Over the last year, the long-term index has declined just 2% as producers continue to retain a more optimistic long-term than short-term view of farmland values. Among producers who expect to see farmland values rise over the next 5 years, the top 2 reasons for their optimism continue to be non-farm investor demand and inflation, chosen by 63% and 23% of respondents, respectively.

This month’s survey included questions about leasing farmland for carbon sequestration. Compared to responses received when we first included questions about carbon sequestration in the first quarter of 2021, it appears that interest in carbon contracts has been relatively consistent. During the first quarter of 2021, approximately 7% of survey respondents said they had engaged in discussions with companies about being paid to capture carbon on their farms. When we repeated the question about carbon payments in August 2022 and again in January 2023, approximately 9% of respondents said they had discussed a carbon contract with a company. Despite producers’ ongoing interest in carbon contracts, few have signed a contract. Just 1% of survey respondents in January reported that they had signed a carbon contract.

Wrapping Up

The improvement in farmer sentiment observed in December carried over into the new year as the Ag Economy Barometer Index rose 4 points above the December reading in January. An improvement in future expectations was the driver behind the modest rise in sentiment, as the Future Expectations Index rose 5 points in January. Although producers were a bit more optimistic about the future this month, they again reported expectations for tighter margins in 2023 than in 2022. Just over one out of five producers expect to have a larger operating loan in 2023 than in 2022, with higher operating expenses being the most commonly cited reason. But producers appear to be entering 2023 in a strong financial position despite the rise in production costs. The percentage of producers who reported the reason for a larger operating loan in the upcoming year declined for the third year in a row, dipping to just 5% in 2023. U.S. farmers continue to express interest in and engage in discussions with companies offering carbon contracts, although to date just 1% of producers report having signed a carbon contract.